Proactive risk management is an important part of MFT Energy’s solid business model. In 2021, the highly volatile markets required a robust and dynamic setup with close monitoring of our overall risk. Our risk management procedures and systems worked very well and were strong contributors to our performance in 2021.

A Cornerstone

Risk management is a cornerstone of MFT Energy’s day-to-day operations and of the execution of our growth strategy. Risk management governs the entire operation and ensures a responsible approach to our activities and implementation of new growth initiatives. The overall objective of the risk management approach is to ensure controlled and value-creating performance and growth. Only calculated risks that lie within the overall business strategy and within approved risk mandates are accepted, and all trading activities are monitored in a systematic approach. This ensures a clear alignment of MFT Energy’s risk appetite with the mandates allocated to the trading teams and their activities.

In 2021, we strengthened our systems, tools and reporting even further by expanding our treasury and risk management setup. This has led to a much more proactive approach with stronger surveillance of mandates and the opportunity to support our teams in their day-to-day execution. Based on this more proactive approach, all mandates have been updated and optimized to reflect the more volatile markets and the opportunities they provide.

On par with our strong market growth and international expansion, the risk management team was further strengthened in 2021. The risk management team has been a key driver in supporting the day-to-day decisions of our trading teams and the execution of their growth strategies.

In 2022, we will further sharpen our focus on supporting the business teams’ expansion and controlled growth. We will continue to optimize our mandates and implement new initiatives to make our data, controls and stress testing even more robust.

Risk Governance

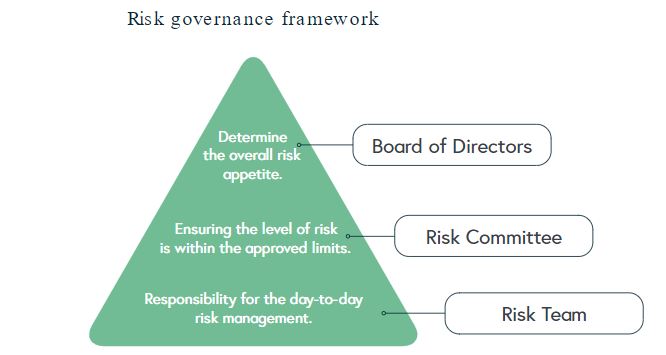

The overall risk appetite at MFT Energy is determined by the Board of Directors. The Board of Directors also ensures that the commercial activities are conducted in a financially responsible manner and that essential risks are mitigated. Further, the Board of Directors has a duty to ensure that the risk appetite is aligned with the instructions given, and that a clear mandate is communicated to the CEO of the company. The CEO charges the Risk Committee with the responsibility of ensuring the level of risk is within the approved limits. The Risk Committee has the sole mandate to approve the implementation of measures associated with increased risk. The Risk Committee makes its decisions based on the information provided by the trading teams. In addition to making information available to the Risk Committee, the Risk Team monitors the approved mandates and implements approved mitigative actions.

Responsibility for the day-to-day risk management activities lies with the Risk Team in close cooperation with all managerial levels, securing risk identification, assessment, mitigation, and monitoring. Our data-driven risk management was of great importance in 2021. MFT Energy applies a risk management framework consisting of a valuation of all trades with future delivery and a risk metric in the form of Value-At-Risk. This provides a clear overall view of how market risk evolves and shows how the different trades have correlated in the past. All of this is reported and monitored daily by the Risk Team.

MFT Energy’s annual report 2021 can be found here