2021 was another record year for MFT Energy. Gross profit increased to EUR 83.7m (+524%) and EBIT increased to EUR 65.4m (+737%). The results outperformed even our most optimistic projections and proved the strength of our business model.

Exceeding our expectations

In 2021, our highly skilled trading teams succeeded in turning a demanding market situation into good business opportunities, increasing the traded volume by 170% to 205 TWh. The increased trading activity was reflected in the numbers. In 2021, gross profit increased to EUR 83.7m compared to EUR 13.4m in 2020 and EBIT increased to EUR 65.4m compared to EUR 7.8m in 2020.

Revenue Growth

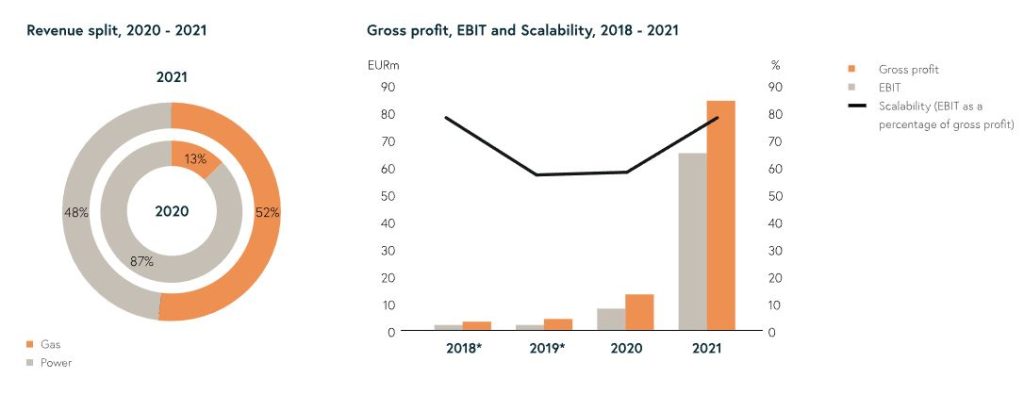

MFT Energy posted 2021 revenue of EUR 1,338.8m, a significant 672% increase from EUR 173.5m in 2020. The improvement was primarily driven by a significant increase in traded volumes derived from all trading teams in existing and new markets – in particular, the gas team experienced significant growth in 2021. MFT Energy Gas was established in 2020, and in 2021 gained a strong position by growing its revenue to EUR 690.4m from EUR 22.6m in 2020, corresponding to 52% of Group revenue in 2021. MFT Energy Power also increased its traded volume significantly in 2021 with posted revenue of EUR 648.4m, up from EUR 150.9m in 2020.

Gross Profit Increase by 524%

Gross profit increased to EUR 83.7m in 2021 from EUR 13.4m in 2020, corresponding to a 524% improvement. More than 87% of the trading days in 2021 produced a positive gross profit with all trading teams contributing. Strong Revenue split, 2020 – 2021 Gross profit, EBIT and Scalability, 2018 – 2021 progress for the gas team led to a different business composition in 2021 and a decline in the gross margin to 6.3% in 2021 from 7.7% in 2020. Gas trading is characterized by higher volumes and lower margins. MFT Energy grew financially stronger during 2021, which enabled the Group to expand its market presence during 2021 and hereby increase gross profit.On par with our strong market growth and international expansion, the risk management team was further strengthened in 2021. The risk management team has been a key driver in supporting the day-to-day decisions of our trading teams and the execution of their growth strategies.

EBIT up to 737%

EBIT improved to EUR 65.4m in 2021 from EUR 7.8m in 2020, corresponding to a 737% increase. The improvement was driven by significantly higher trading activity without increasing costs to the same extent. As a result, scalability (EBIT as a percentage of gross profit) increased to 78% in 2021 from 58% in 2020.

Staff costs increased to EUR 13.6m in 2021, up from EUR 3.8m in 2020 due to a 60% increase in our headcount to 87 employees at the end of 2021 and an increase in bonus payments. New hires were made for both the trading and support teams, and these recruitments were implemented with the ambition to have two thirds of our total staff working on our trading teams. Other external expenses grew to EUR 4.6m in 2021 from EUR 1.7m in 2020. The increase was linked to the expansion of the trading activity and to the further improvements made to MFT Energy’s platform. Net financial expenses totaled EUR 1.6m in 2021 up from EUR 0.7m in 2020. The net financial expenses mainly related to interest on loans and costs of credit facilities to be used for trading purposes.

Strong Cash-Flows

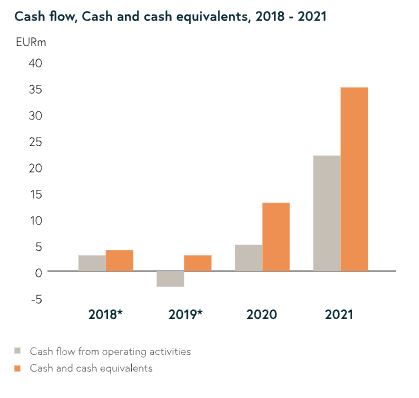

Cash flow from operating activities rose to EUR 22.5m in 2021 from EUR 5.2m in 2020. The increase in EBITDA had a positive effect on the cash flow, which was partially offset by the increase in net working capital. The increase in net working capital was mainly due to an increase in collaterals required for the trading activities. Gas Power Gross profit EBIT Scalability (EBIT as a percentage of gross profit) Cash flow from investing activities was an outflow of EUR 1.0m in 2021 compared to an outflow of EUR 0.3m in 2020. Cash flow from financing activities was an outflow of EUR 0.4m in 2021 compared to an inflow of 5.7m in 2020. In 2020, new loans led to an inflow of cash. Loans were partly repaid in 2021, and lease obligations were added as part of the IFRS implementation. The total change in cash and cash equivalents was an inflow of EUR 21.9m in 2021, which was an improvement from EUR 10.6m in 2020.

Solid Capital Structure

At the end of 2021, total assets amounted to EUR 481.3m as compared to EUR 41.7m in 2020. The EUR 439.6m increase was mainly linked to derivatives held for trading, which caused an increase of more than EUR 320m in assets and liabilities. Under IFRS, derivatives must be reported gross per counterparty and the increase in trading activities has had a significant effect on total assets.

Other receivables increased to EUR 79.5m in 2021 from EUR 9.2m in 2020 mainly due to an increase in collaterals required for trading activities, and cash and cash equivalents increased by EUR 21.9m to EUR 34.5m in 2021. At 31 December 2021, MFT Energy had equity of EUR 61.4m, up by 541% from EUR 9.6m at 31 December 2020. The increase was linked to the profit for the year.

The return on equity increased from 82% in 2020 to 141% in 2021. The equity ratio declined from 23% to 13%, adversely affected by the above-mentioned increase in net assets. The large amount of derivatives on the balance sheet is due to IFRS requirements but the actual risk and exposure for the Group is only the net position of the derivatives in the assets and liabilities. According to the IFRS requirements, the balances have been offset in regards of similar products and contractual equalities.

MFT Energy’s annual report 2021 can be found here