Renewable resources like wind and solar are expected to grow at accelerated pace. Hence, the green transition will continue to be the key driver of change in the energy markets. We expect the need for power and gas trading across markets to increase because unstable renewable sources play a decisive role. At MFT Energy, we trade power and gas across borders. Every day, our trading activities facilitate the distribution of power from renewable sources such as wind, solar, and hydro contributing to efficient pricing and an optimal use of renewable energy.

Renewables Create Market Opportunities

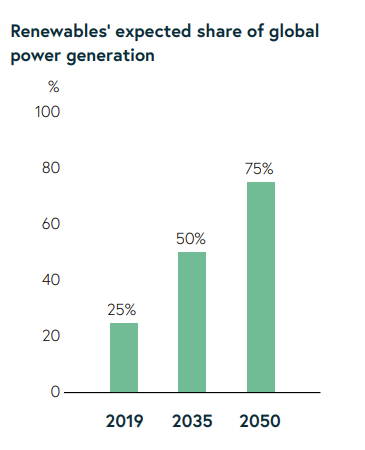

As part of the ongoing decarbonization, wind farms and solar plants are rapidly gaining a large share within power generation. From making up about 25% in 2019, renewables are expected to grow their share of the global power generation mix to 50% by 2035 and climbing to 75% by mid-century. The pace may potentially be accelerated by political intentions to make Europe less dependent on natural gas.

As renewable energy is dependent on weather conditions, a large part of the generation mix will inherently be unstable. As the proportion of unstable resources in the total generation mix is growing, energy markets will experience an increasing need for balancing supply and demand. Particularly when wind and solar generation reach a relatively large share, which is the case for the more mature markets

Fluctuations in the output from renewable sources will drive the need for distributing power and gas across borders from areas where there is a surplus to areas where there is a shortage. MFT Energy holds a strong position in the market areas with the highest activity and traded volumes, and our trading teams apply their specialist market knowledge and data in executing their well-proven strategies.

Electrification Drives Demand for Power

The growth in electrification across all key end user groups, particularly in buildings and road transport is expected to lead to a doubling of power demand by 2050 and to grow power’s share of overall energy consumption from around 20% today to around 30% in 2050.

The increasing demand for power in combination with the larger share of renewables in the generation mix will contribute further to the growing need for distributing power and gas across markets.

Growing Demand for Natural Gas

Natural gas is expected to grow its share of the overall energy demand until 2035, and demand is expected to grow slightly across all key sectors using natural gas. From 2035 to 2050, total demand is expected to plateau with relatively steady demand from all sectors.

Natural gas is the most environmentally friendly of the fossil fuels and often becomes a stable baseload and dispatchable capacity provider in the power generation mix. Natural gas therefore plays an important role in the generation of power if renewables or other resources are unable to meet demand.

Volatility Creates Trading Opportunities

MFT Energy’s trading teams have in-depth knowledge of the supply and demand dynamics in their respective markets and regions and are available for trading 24/7. Our business model and excellence in data analytics will create significant market opportunities in the ongoing green transition. As our business model converts market knowledge and data into different strategies, increasingly volatility creates trading opportunities for our teams. In combination with the expected increase in traded volumes, this will be a key driving force of the future earnings potential of MFT Energy.

MFT Energy’s annual report 2021 can be found here. Our partner model enables talented people to become engaged business owners and creates a dynamic, enjoyable, and profitable work environment for everybody.